UPDATE

PA Start-up Penalty reform was included the FY 2024-25 state budget – a major win that will help businesses locate, invest, and hire in Pennsylvania. This victory is an important first step toward making Pennsylvania more competitive!

Beginning in 2025, the PA Start-up Penalty will be reduced incrementally each year until Pennsylvania’s treatment of losses for start-up businesses aligns with federal rules.

Specifically, the state’s 40% deduction cap will be increased for Net Operating Losses (NOLs) generated in the 2025 tax year (and beyond) to 50% in 2026, then 60% in the year following year, until it reaches parity with the federal cap (80 percent) in the year 2029.

What is It:

- For many businesses, it takes a while to turn a profit. In the first few years, it’s common to operate at a loss.

- While most other states allow struggling businesses to “carryforward” those losses (80% or more) to the next tax year, Pennsylvania is behind 48 other states, only allowing a 40% carryforward.

- This means if a business operates at a massive loss one year, yet barely makes a profit the next, they are slammed with unaffordable (and unfair) taxes.

Why it Matters:

- An inability to carryforward losses at the same level as 48 other states means Pennsylvania businesses would be better off moving elsewhere and taking their jobs with them. (And they are leaving.)

- It also means businesses in Pennsylvania are less likely to get off the ground. Sadly, they are put out of business before they ever had the chance to thrive.

- As these businesses fail, jobs and economic opportunity leave Pennsylvania.

- Without a supportive tax environment, there is little motivation for entrepreneurs in Pennsylvania to pursue the American dream of starting a business and improving local communities.

The Fix:

- Senate Bill 346 would eliminate Pennsylvania’s Startup Penalty by bringing Pennsylvania in line with the federal government and the 48 other states that allow struggling businesses to carryforward 80% of their losses.

- This will ultimately keep struggling businesses afloat long enough to make it and create an atmosphere of economic opportunity for all.

The Latest:

- 73 Chambers of Commerce Urge Elimination of PA’s Start-up Penalty

Read the letter HERE - The PA National Federation of Independent Businesses (NFIB) hosted a press conference April 8, calling for an end to the PA Start-up Penalty, emphasizing that it is an “obstruction to prosperity” and it “thwarts entrepreneurship.”

Watch a portion of the NFIB press conference below.

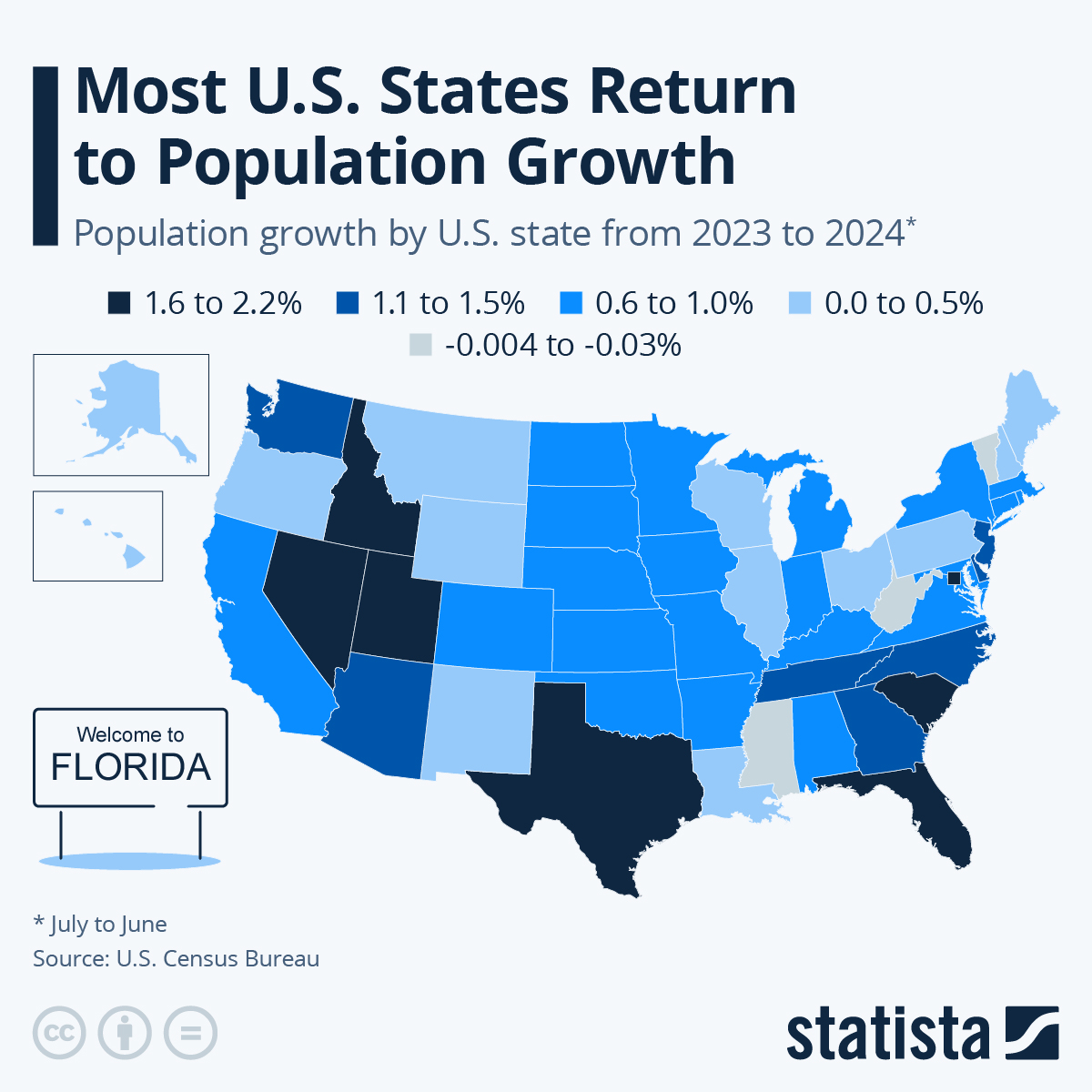

You will find more infographics at Statista

You will find more infographics at Statista

By eliminating Pennsylvania’s Startup Penalty, we can send a message to hardworking people and job-creators everywhere that Pennsylvania is finally open for business.