|

||||

|

In this Update:

Senate Concludes First Week of Budget Hearings

The Senate Appropriations Committee began public hearings this week on the proposed 2025-26 state budget. Gov. Josh Shapiro’s budget plan would increase state spending by more than $3.6 billion, or about 7.5% above the current year’s budget. During the next five years, using realistic spending and revenue estimates, Shapiro’s spending plans would leave a $27.3 billion hole in the state’s finances. Among the highlights: The Department of Revenue hearing focused on the inflated revenues Gov. Josh Shapiro used to balance his spending proposal. Revenue Secretary Pat Browne confirmed the state is only expected to bring in approximately $47.5 billion in revenue under existing law. Balancing Shapiro’s budget would require elimination of the state’s entire existing fund balance of nearly $3 billion and a transfer of $1.6 billion from the state’s emergency savings, known as the Rainy Day Fund. Following his plan would cause serious financial issues. At the Pennsylvania State System of Higher Education (PASSHE) and Pennsylvania Higher Education Assistance Agency (PHEAA) budget hearing, the committee sought information about how PASSHE is working to right-size the system given steep declines in enrollment and to minimize student debt. The new Grow PA Scholarship Grant Program, made possible by the support of Senate Republicans, provides $25 million in funding for students earning degrees and completing job training programs in high-demand industries. The State Police budget hearing highlighted Shapiro’s budget proposal for the State Police that would slow the phase-out from the Motor License Fund, making $375 million less available for road and bridge repairs. There were also questions about how the State Police would handle Shapiro’s plan to legalize recreational cannabis use. At the Department of Health budget hearing, members shared health-focused concerns regarding Shapiro’s plan to legalize recreational cannabis use. While most doctors prescribe fewer than 100 medical marijuana certifications, three doctors prescribed more than 11,000. Access to health care, particularly in rural areas where hospitals have been closed, was also discussed. Thursday’s hearings include the Department of State and the Department of Transportation. Find the hearings schedule, livestreams of budget hearings, daily recaps and video from prior hearings at PASenateGOP.com. Property Tax and Rent Rebates

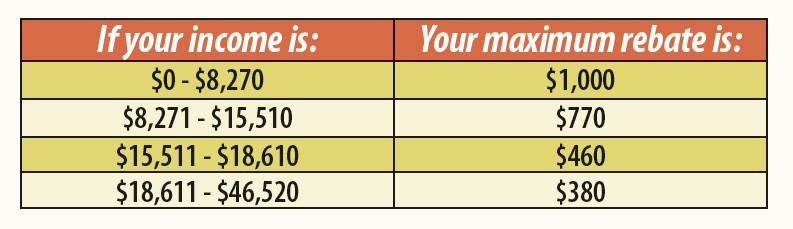

More residents are eligible for rebates than in previous years due to an increase in allowable income. The Property Tax/Rent Rebate Program is funded by lottery revenue and is open to state residents who:

AND

Rebate amounts are calculated based on applicants’ 2024 income and the amount of property tax or rent paid in 2024, with rebates ranging from $380 to $1,000. Application assistance and electronic filing are available in each of my district offices. Although appointments are not required for rebate assistance, they are recommended. Help for Taxpayers

I’ve introduced legislation to eliminate the state Personal Income Tax. Until that becomes a reality, resources and tools available through the Pennsylvania Department of Revenue can help simplify the process and reduce the procedural burden on many taxpayers. Direct File Roughly 2.1 million Pennsylvanians are eligible this tax season to use Direct File. This online tax filing tool offers taxpayers the option to file their federal and state tax returns at no cost directly with the IRS and Department of Revenue. The IRS offers an eligibility checker at directfile.irs.gov. Direct File is currently designed for Pennsylvanians with common tax situations. For example, it supports these types of income:

Additionally, Direct File may be a good option for those who:

Those eligible for Direct File, will be walked through interview-style questions to prepare their returns, just as with other tax preparation software platforms. Visit pa.gov/directfile for further information. Taxpayer Service and Assistance Taxpayers can check the status of their refunds online by visiting Where’s My Income Tax Refund? or by calling 1-888-PATAXES. Taxpayers will be prompted to provide their Social Security number and requested refund amount to obtain the current status. Free tax forms and instructions are available at www.revenue.pa.gov. Free Electronic Filing Other free electronic filing options are available to file state and federal returns using software from vendors. More vendor information is available on the Department of Revenue’s website. As we prepare to file taxes this time of year, it’s a reminder that government has no money of its own; every penny comes from taxpayers, which is why fiscal responsibility and good stewardship are essential. Here to Serve You

My staff and I pledge to make state government accessible. We’d be honored to:

For information about any of these services or to provide input on pending legislation, please contact me at www.SenatorRothman.com or call one of my district offices. My staff and I are here to serve you. Recognizing National FFA Week

George Washington said, “Agriculture is the most healthful, most useful and most noble employment of man.” It’s also one of our state’s top industries. Career opportunities in agriculture extend far beyond animal and crop production. Those interested in science, business, technology, and mechanics can find fulfilling careers in agriculture. The industry requires the skills of professionals in a wide variety of fields to meet demands for food, fiber and fuel production. National FFA Week, which runs from Feb. 15-22, is a great time to consider career possibilities and to appreciate the many men and women who already serve in this critical industry.

If you are not already subscribed to this newsletter please sign up here. |

||||

|

||||

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://senatorrothman.com | Privacy Policy |